This post will walk you through the process and tools I use to make charging, recording and paying NM gross receipts tax for my business easy. I have finally found a way to make this process pain free, so I want to share.

(Of course, all the disclaimers apply – I’m not a lawyer, a tax person, etc. and even if I was one of those things, I wouldn’t be your lawyer, or tax person, etc. My qualifications include being a software geek, having spent hours pouring over the gross receipts laws to try to make sure I’m doing it right for my business and testing many software products for myself and my clients to try to figure out which ones make it possible to charge NM GRT correctly.)

What is New Mexico’s Gross Receipts Tax?

Unlike most states which charge a sales tax on goods sold, New Mexico charges a Gross Receipts tax on goods and services. If you are doing business in New Mexico chances are you need to be aware of this.

- Out of state sellers selling to buyers in New Mexico can owe NM GRT

- Service providers selling any sort of service (hair sytlists, web developers, lawyers, etc.) all owe GRT if they are providing services to buyers in NM.

Two things combine to make situation where New Mexico’s Gross Receipts Tax can be really complicate to calculate. At least in my case – there are also different rules and deductions that apply to different types of businesses.

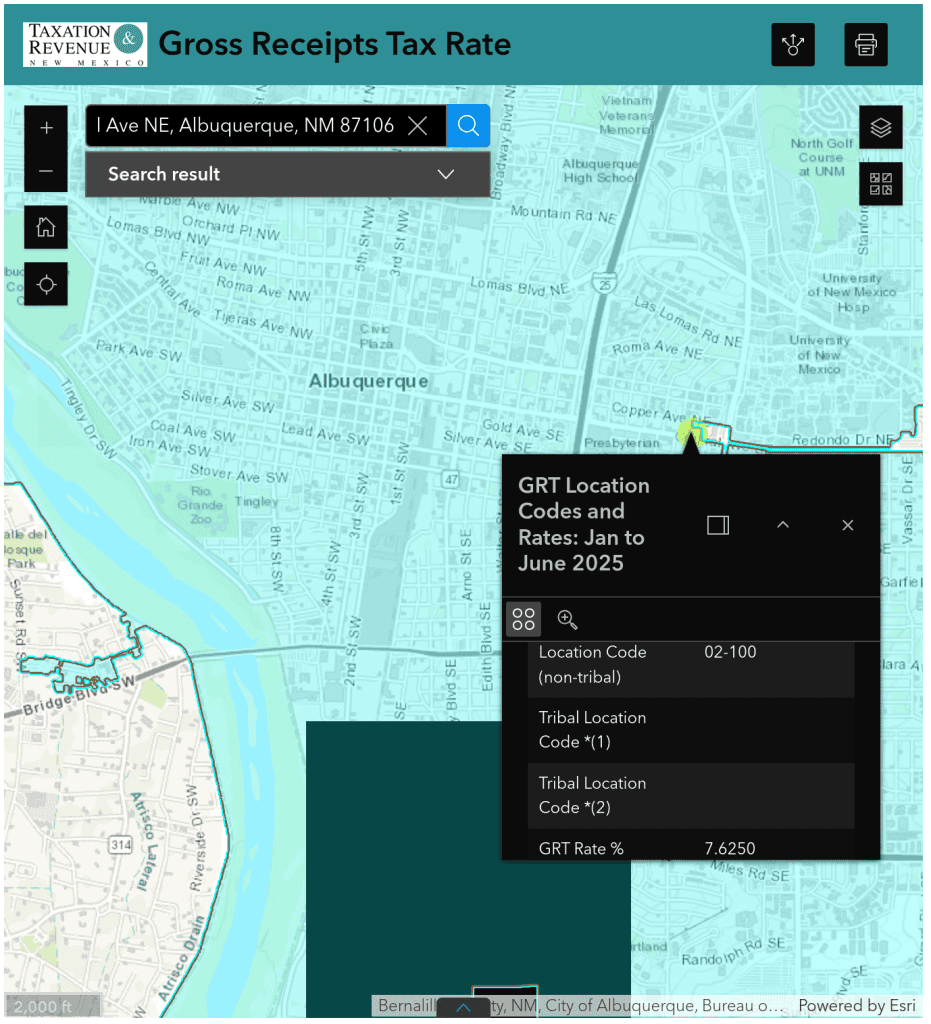

- The first is that the rate depends on the area of the state with hundreds of different zones across the state. The state has a map you can use to look up the correct zone and rate for an address.

- The second is that for many businesses, you owe tax based on the location of your buyer, not your business. So now you need to keep track of different locations and tax rates for different transactions or clients.

(As an aside, ecommerce businesses selling in NM must charge GRT based on the location they are shipping to – they have the burden on calculating GRT for all of these zones and many services that calculate tax do not actually handle this at all correctly for NM.)

As a web developer with in New Mexico, I serve clients across the country, but I have a large percentage of local clients. Because my clients are spread across different tax zones in New Mexico, I am required to pay gross receipts tax based on their location. This post will walk you through how I keep track of this.

My tools

I used to use PayPal to do all invoicing – it DOES at least allow you to set different tax rates, however, there is no way to attach these to a customer, so you have to remember to reset them every time you send out a new invoice. This worked as I was starting my business but became more and more of a pain as my business grew.

I also just calculated the tax I owed using a spreadsheet early on in my business. This worked, but eventually I just got really tired of it. It is not how I want to spend my time.

Then I switched to using Moxie (affiliate link) and it does all of the things for me. Here’s my process now.

#1. Look up a client’s zone and current tax rate.

I get a client’s business name and business address as part of my on-boarding process. Then the state maintains a website with a map where you can search an address and find the GRT Location Code and Rate.

I search for my client’s business address. Then if you click at that location on the map, a popup box will give you the information you need. I record the County, Name, Location Code and Tax Rate. For example

- Quelab Makerspace – (not a client, just a place I like)

- 511 Central Ave NE, Albuquerque, NM 87106

- County: Bernalillo

- Name: Albuquerque (This is the name of the zone, but in this case it matches the city name)

- Location Code 02-001

- GRT Rate %: 7.6250 (This can change every 6 months for every location code – yet another way NM makes this whole thing hard!)

#2. Put the client in Moxie and set payment details

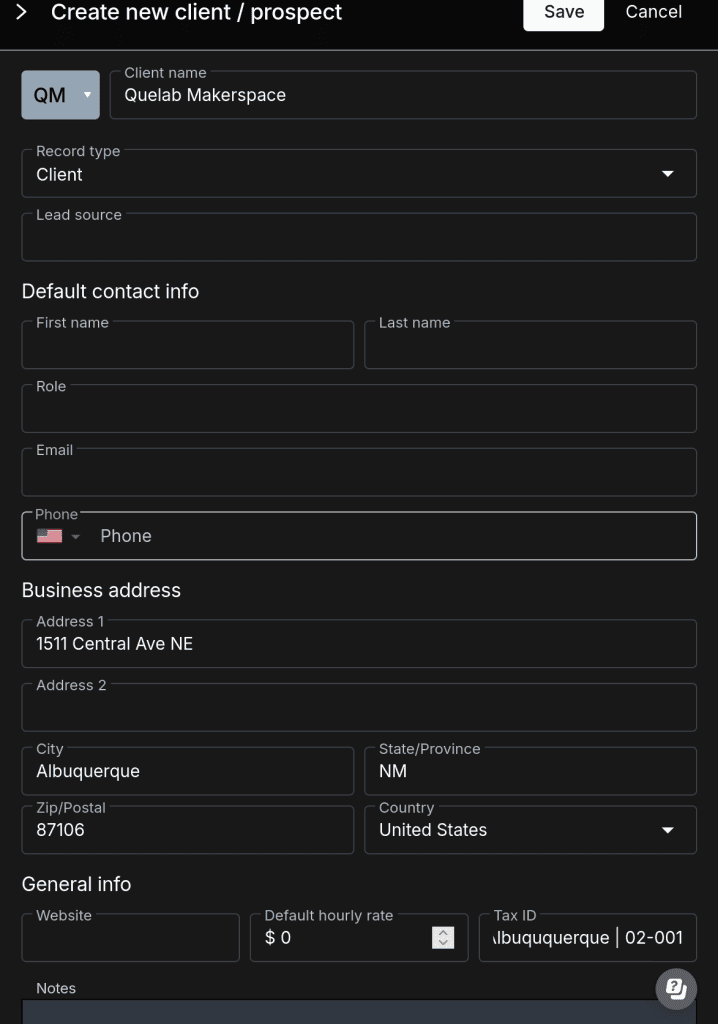

When I create the new client, I make sure and fill in:

- The Client name

- The Business address

- The Tax ID: Bernalillo: Albuquerque | 02-001

Then I save the client.

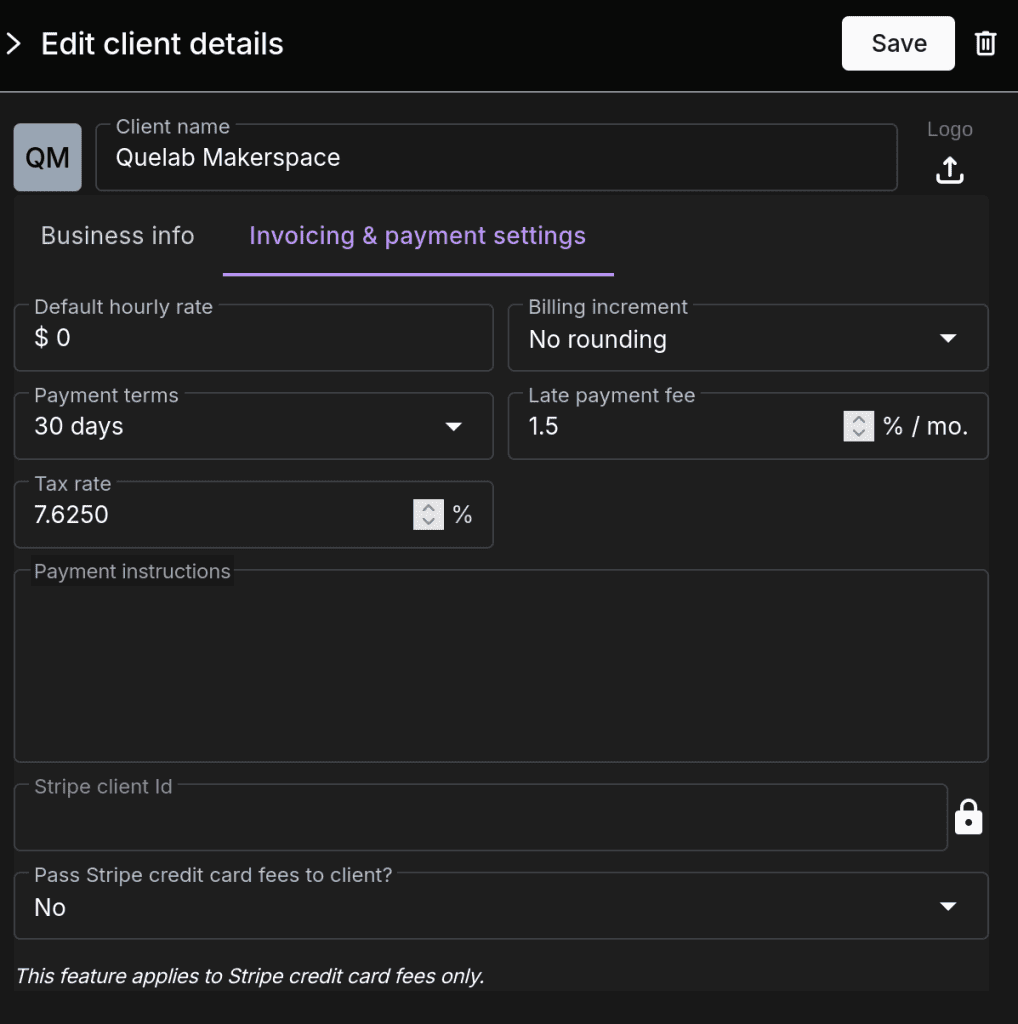

After that, editing the client, there is an ‘Invoicing & payment settings’ tab where a Tax rate can be set for the individual client. This is crucial for being able to handle GRT in NM. (One of the reasons I love Moxie is this options. There were other solutions I skipped over because they did not have a way to customize tax rates by client.)

I just put in the tax rate that I got from the map earlier.

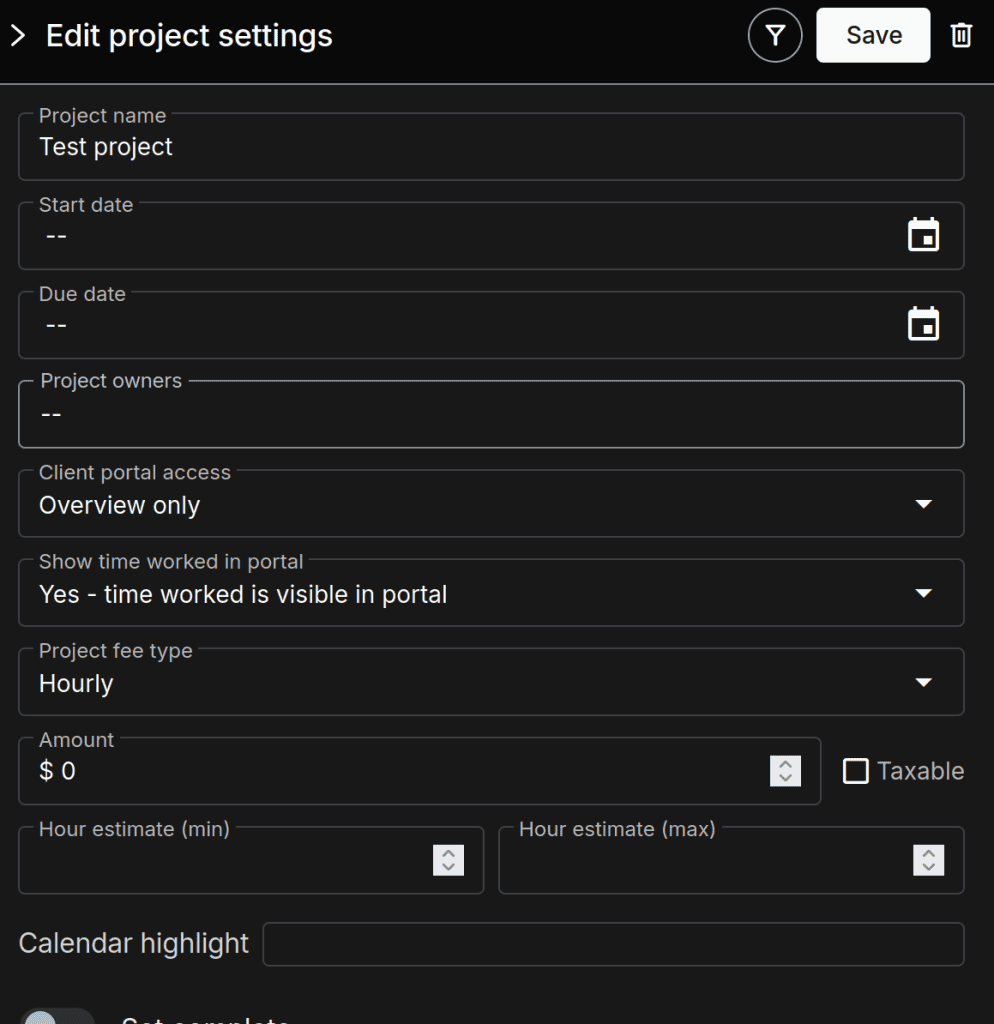

#3. Set projects and services to taxable or not

Individual projects and services can be set to be taxable or not as well. So when I create projects for a client, I make sure and check the box to make the project taxable if it should be.

(I do have one client that some work is taxable because it is for that client and other work is not taxable because I am working as a subcontractor so this option to determine whether or not things are taxed at the project level has really come in handy for me).

#4. Invoice clients. Get Paid.

Once this setup is complete, it’s easy to just invoice clients using Moxie’s built in invoicing which works really well.

Moxie allows you to connect both PayPal and/or Stripe accounts for online payments and has a host of features that makes billing and invoicing really easy to setup and handle.

#5. Download Report

When it’s time to file to pay GRT, one goes into Moxie to Accounting>Reports and sets the time frame one needs. The tax data does not show up, but clicking ‘Download’ generates an Excel sheet that includes a ‘Taxes collected’ table.

This spreadsheet has the date, client, tax ID, invoice #, invoice total, total taxable amount, total non-taxable amount, tax collected, and tax rate for every invoice. This can then be sorted by tax ID.

#6. Aggregate Data

NM requires that you report your earnings for each Tax Area separately. So I just sort the sheet by tax ID, total the transactions for each and use that data to file.

Summary

Setting everything up like this means that Moxie is doing all the work for me. I’ve been extremely happy with the way it’s been working!

If you’d like to try out Moxie, you can get a 14 day free trial with my affiliate link. But I really just share all of this because I know how dreadful it is to spend a Wednesday morning tallying up gross receipts tax totals in Google Sheets and maybe I can spare somebody else from that.

Do you have any questions about this? Feel free to reach out!